Introduction: Unlocking Property Investment – A Closer Look at The Cap Rate

III. The Crucial Role of The Cap Rate in Investment Strategy

A. Strategic Evaluation of Investment Opportunities

In the world of property investment, making the right decisions is like playing a game of chess. Cap Rate serves as your strategic advisor. We’ll explore how investors use Cap Rate to assess opportunities. Is this property a smart move? Should you look elsewhere? By understanding Cap Rate, you gain an edge in the game, making calculated moves to maximize your gains.

B. Risk Mitigation and Return Projection

Every investment involves risks, and the goal is to minimize them while aiming for a good return. Cap Rate acts as your risk radar. We’ll show you how it helps investors foresee potential risks and project future returns. It’s like having a crystal ball that guides you through the uncertainties of the property market.

C. Cap Rate as a Comparative Metric

Comparing different properties is a challenge. One might look great on the surface, but is it the best choice for your investment goals? Cap Rate is your comparative metric, helping you stack properties side by side. You’ll learn how to use Cap Rate to compare apples to apples, ensuring you make informed decisions based on solid financial reasoning.

IV. Navigating Cap Rate Influencers

A. Locational Dynamics: A Key Determinant

One of the big factors influencing Cap Rate is location. Imagine you’re choosing between two properties – one in a bustling city center and another in a quiet suburb. Location plays a crucial role in how much money a property can make and, consequently, its Cap Rate. We’ll break down how different locations can impact your investment strategy.

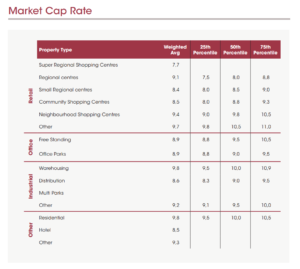

B. Property Types and Their Impact

Not all properties are created equal. A small apartment complex might have a different Cap Rate than a big shopping mall.

C. Navigating Market Dynamics

Markets are like oceans – they can be calm or stormy. The real estate market is no different. Being aware of these changing market dynamics empowers you to make strategic decisions based on the broader economic picture.

D. Economic and Operational Factors

Beyond location and property type, economic factors like interest rates and operational expenses like maintenance costs also affect Cap Rate. We’ll shed light on how changes in the economy or the day-to-day costs of running a property impact the all-important Cap Rate.

V. How Market Conditions Affect The Cap Rate

Market conditions play a pivotal role in influencing area Cap Rates, reflecting the broader economic environment and investor sentiment. Understanding these dynamics is crucial for property investors as Cap Rates provide insights into the relationship between a property’s income and its market value.

Here’s how different market conditions can impact area Cap Rates:

- Interest Rates and Financing Availability:

- Low-Interest Rates: In a low-interest-rate environment, financing costs are reduced, making it easier for investors to secure loans. This often leads to increased demand for properties, potentially driving up prices. Higher property values relative to income can result in lower Cap Rates.

- High-Interest Rates: Conversely, when interest rates are high, financing becomes more expensive. This can lead to decreased demand, lower property values, and higher Cap Rates as the income generated by the property becomes more significant in relation to its market value.

- Economic Growth and Market Demand:

- Strong Economic Growth: Robust economic conditions often result in increased demand for real estate. High demand can drive property prices upward, potentially lowering Cap Rates as market values rise faster than rental incomes.

- Economic Downturn: During economic downturns, demand may decrease, leading to lower property values. If rental incomes remain relatively stable, this can result in higher Cap Rates as the property’s value declines.

- Supply and Demand Dynamics:

- High Demand and Low Supply: Areas with high demand and limited property supply may experience increased competition among buyers, leading to higher property values. This can result in lower Cap Rates as the income generated by the property may not keep pace with rising market values.

- Low Demand and High Supply: Conversely, areas with low demand and an oversupply of properties may experience decreased property values. In such cases, Cap Rates may rise as the income becomes a more significant factor in determining value.

- Local Economic Factors:

- Job Growth and Economic Stability: Areas with strong job growth and economic stability can attract more residents and businesses, potentially increasing property demand and values. This can lead to lower Cap Rates.

- Economic Decline or Job Loss: Economic challenges or job loss in an area can lead to decreased demand and lower property values. Higher Cap Rates may result as the income generated by the property becomes more critical in relation to its market value.

- Market Sentiment and Investor Risk Appetite:

- Bullish Market Sentiment: Positive market sentiment and investor confidence may lead to higher property values, potentially resulting in lower Cap Rates.

- Bearish Market Sentiment: Negative sentiment and increased risk aversion among investors may lead to decreased property values, potentially resulting in higher Cap Rates.

Understanding how these market conditions impact area Cap Rates is essential for property investors to make informed decisions. Monitoring economic indicators, local market trends, and investor sentiment can help you anticipate changes in Cap Rates and adjust your strategies accordingly.

VI. A Step-by-Step Guide to Calculating Cap Rate

A. Gathering Essential Data

- Rental Income: Let’s start by determining the annual rental income. Suppose your property earns R8,000 per month. The annual rental income would then be R96,000.

- Operating Expenses: Identify the annual operating expenses, including property management fees, maintenance costs, property taxes, and insurance. If these expenses total R20,000 annually, this becomes a crucial figure.

B. Applying the Cap Rate Formula

The Cap Rate formula is expressed as follows:

Cap Rate = (Net Operating Income / Current Market Value)×100

1.Net Operating Income (NOI): Subtract the annual operating expenses from the annual rental income. Using the numbers from our example:

NOI=Rental Income−Operating Expenses=R96,000−R20,000=R76,000

2. Current Market Value: Determine the current market value of the property. If the property is valued at R1,200,000, this is the figure to be used. Note that very often this figure is not available in practice. We will cover how to overcome this problem too.

3. Cap Rate Calculation: Plug the numbers into the formula: Cap Rate=(Net Operating Income/Current Market Value)×100

Cap Rate=(R 76,000/R1,200,000)×100

Cap Rate≈6.33%

C. Interpretation of Calculated Results

The calculated Cap Rate of approximately 6.33% signifies that, based on the property’s current market value, the annual net operating income represents a return of approximately 6.33%.

Investors often interpret higher Cap Rates as indicating potentially higher returns, although it’s crucial to consider the broader context of the real estate market and individual investment goals.

The Cap rate should be assessed to the area where the property is located and the quality of the property. The more risk a property or area has, the higher the Cap rate for that property.

For example in an area like Sandton you can expect Cap rates of between 7% to 9%. While cap rates in the JHB CBD may be as high as 14% to 18%. Hence Sandton is a lower risk area so you would expect a lower rate of return for properties located there.

It is important to note that area cap rates fluctuate with economic and market conditions. They are never fixed. This is why we always have to do research to find out what the cap rate is for every property we look at.

VII. What If You Don’t Have The Market Value Of The Property?

As you have seen, the Cap Rate formula relies on having two important numbers: the Nett Operating Income and the Market Value of the property.

In practice however, especially for commercial properties, the market value amount will not be available.

Thus we actually need the Cap Rate to determine the market value of the property. This gives us the following formula:

Market Value of Property = NOI (Nett Operating Income) / Cap Rate

So how do we find the Cap rate then?

During my days in banking this was one of our main tasks, finding the value of the property so we could determine the loan amount to grant a client. We would conduct what we used to call “Desktop” property valuations.

To do this, we would use market reports from Rode, SAPOA, other industry bodies and especially commercial property valuers, to find the Cap Rate for various areas. Because these organizations and professionals conduct market analysis daily through thousands and thousands of reports, they accumulate loads of data and publish their findings in paid reports.

These reports provide data on the Cap rates for various areas. Bankers and property professionals then rely on this data to find the required Cap Rate ranges for each suburb.

So Cap Rates sourced from these organizations are essentially averages sourced from all the data available for each suburb and area.

Cap rates are then reported in the form of a range, for example a valuation report might state that the average Cap Rate for Turffontein (in Johannesburg South) is 12% to 14%. And based on the valuer’s expertise, he will then select a number (for example 13.5%) from that range based on the property condition and location within the suburb.

So when using the Cap Rate, if you are not familiar with a suburb, you would access data from these organizations or commercial property valuers and commercial property bankers to determine the Cap Rate to be used in your market valuation calculations.

In daily practice you are thus more likely to calculate the property value for a property by determining the Cap Rate from info you get from various sources. And you are less likely to spend your time actually calculating the Cap rate.

The more deals you look at, the more familiar you become with what the Cap Rates are for various areas. Then it’s just a case of taking that Cap Rate and plugging it into your formula to find the “desktop” value of the property.

VIII. Decoding Cap Rate Results

Now that you’ve crunched the numbers, it’s time to make sense of them.

High Cap Rates (12% and above) may signal certain investment opportunities, while low Cap Rates (say below 10%) might suggest a more stable and safe property investment or even an expensive over priced property that you may want to overlook.

The Cap Rate must always be assessed based on the location of the property and then also the physical condition and quality of the tenant profile.

Sample Cap Rates

Aslam is from Johannesburg, South Africa and graduated with a BComm degree from the University of South Africa and followed that up with a BComm Hons degree in Finance and Investments.

He has spent over 18 years in the financial services sector, with 12.5 years in the commercial property finance arena with 3 of the major banks in the country.

His specialty being deal structuring and finance solutions for commercial property investors and developers across the commercial property sector, including large scale retail developments, high density residential investments , industrial and office property.

Aslam was also a fast food franchise investor for 7 years, is experienced in digital marketing and online lead generation and has owned and managed multiple residential properties.