Hard Money Lending: A Path to Property Wealth Without The Tenant Stress

Are you tired of the traditional 9-to-5 grind, and searching for a way to financial freedom and passive income?

Maybe you even considered investing in property but were turned off by the problems that come from managing tenants?

If so, hard money lending might be the answer you’ve been searching for.

Private money lending or hard money lending as it is also known, is a strategic approach to property investing that allows you to provide capital to property developers and investors in exchange for attractive interest rates.

By becoming a private lender, you can tap into the world of property investing without the hassle of property ownership, management, or tenant headaches.

In this article, we will get into the world of hard money lending, exploring its benefits, risks, and practical steps to get started.

Understanding Hard Money Lending

What is Private Money Lending?

Private money lending, often referred to as hard money lending, involves individuals or groups providing capital to property investors, flippers and developers who need funding for various projects, such as property acquisition, renovation, or construction.

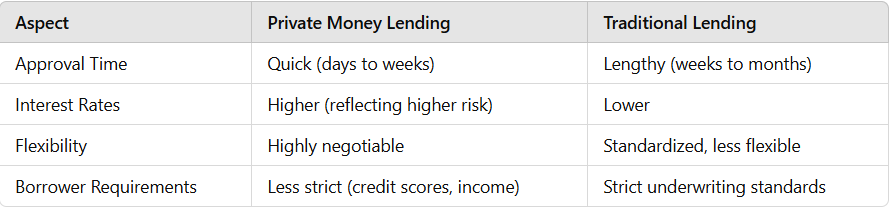

Unlike traditional banks, private lenders often offer quicker approval processes and more flexible terms, making them a popular choice for property professionals who may not qualify for traditional financing or need funds quickly.

The Challenge of Raising Capital in Property

Real estate investment requires substantial capital, whether for purchasing properties, renovating distressed assets, or bridging financial gaps in ongoing projects.

However, many investors face significant barriers when seeking traditional financing:

- Stringent Loan Requirements: Banks often demand excellent credit scores, detailed income verification, and low debt-to-income ratios.

- Lengthy Approval Processes: Traditional loans can take weeks or even months to process, delaying time-sensitive deals.

- Limited Financing Options: Investors working on unconventional projects, such as flipping properties or developing land, often find banks unwilling to fund their plans.

These hurdles can make it nearly impossible for property investors to act quickly, especially in competitive markets where deals are won or lost in days.

How Private Money Lending Solves the Problem

Hard money lenders step in to bridge this gap by offering a more practical and accessible alternative.

Here’s how they help property investors:

- Speed: Unlike traditional banks, private lenders prioritize quick approvals and funding. Many loans are processed in days, allowing investors to seize opportunities without delay.

- Flexibility: Private lenders tailor their terms to the borrower’s needs. This includes customizing repayment schedules, loan durations, and interest rates.

- Focus on Assets, Not Credit: Hard money lenders place greater emphasis on the value of the property securing the loan rather than the borrower’s financial history, making it easier for those with imperfect credit or inconsistent income to qualify.

- Support for Non-Traditional Projects: Private loans are ideal for real estate ventures like house flips, rehab projects, or short-term bridge financing—projects traditional lenders may deem too risky.

Key Features of Private Money Lending

- Collateral-Driven: Loans are secured by the property itself, reducing the lender’s risk and increasing access for borrowers.

- Short-Term Financing: Loans typically range from 6 months to 3 years, designed to support specific project timelines.

- Higher Interest Rates: Borrowers pay premium rates (usually Prime plus 3% and higher) in exchange for faster and more accessible capital.

- Tailored Solutions: Terms are negotiated directly between lender and borrower, offering unmatched flexibility.

A Game-Changer for Property Investors

For property investors, private money lending is more than just a financing option—it’s a competitive advantage.

Whether it’s securing a fixer-upper, funding a time-sensitive auction purchase, or bridging the gap between deals, private money lenders provide the liquidity and speed investors need to succeed.

By solving the capital challenge, private lending empowers investors to focus on what they do best: creating value through real estate.

How Does Private Money Lending Work?

The process of private money lending typically involves the following steps:

- Finding a Borrower: Network with real estate investors, brokers, and property developers to identify potential borrowers.

- Underwriting the Deal: Carefully evaluate the borrower’s creditworthiness, the property’s value, and the proposed project’s feasibility. Key factors to consider include:

- Borrower’s Experience and Reputation: Assess the borrower’s track record in the real estate industry.

- Property Appraisal: Obtain a professional appraisal to determine the property’s fair market value.

- Project Feasibility: Analyze the project’s business plan, budget, and potential return on investment.

- Exit Strategy: Consider the borrower’s exit strategy, such as selling the property, refinancing, or holding it as a rental property.

- Negotiating Terms: Determine the interest rate, loan term, loan-to-value (LTV) ratio, and any additional fees or points.

- Securing the Loan: Draft a promissory note outlining the terms of the loan and ensure that the property is appropriately secured as collateral.

- Disbursing Funds: Once the loan terms are agreed upon, disburse the funds to the borrower.

- Monitoring the Loan: Regularly monitor the borrower’s progress and ensure that they are meeting the terms of the loan agreement

Aslam is from Johannesburg, South Africa and graduated with a BComm degree from the University of South Africa and followed that up with a BComm Hons degree in Finance and Investments.

He has spent over 18 years in the financial services sector, with 12.5 years in the commercial property finance arena with 3 of the major banks in the country.

His specialty being deal structuring and finance solutions for commercial property investors and developers across the commercial property sector, including large scale retail developments, high density residential investments , industrial and office property.

Aslam was also a fast food franchise investor for 7 years, is experienced in digital marketing and online lead generation and has owned and managed multiple residential properties.