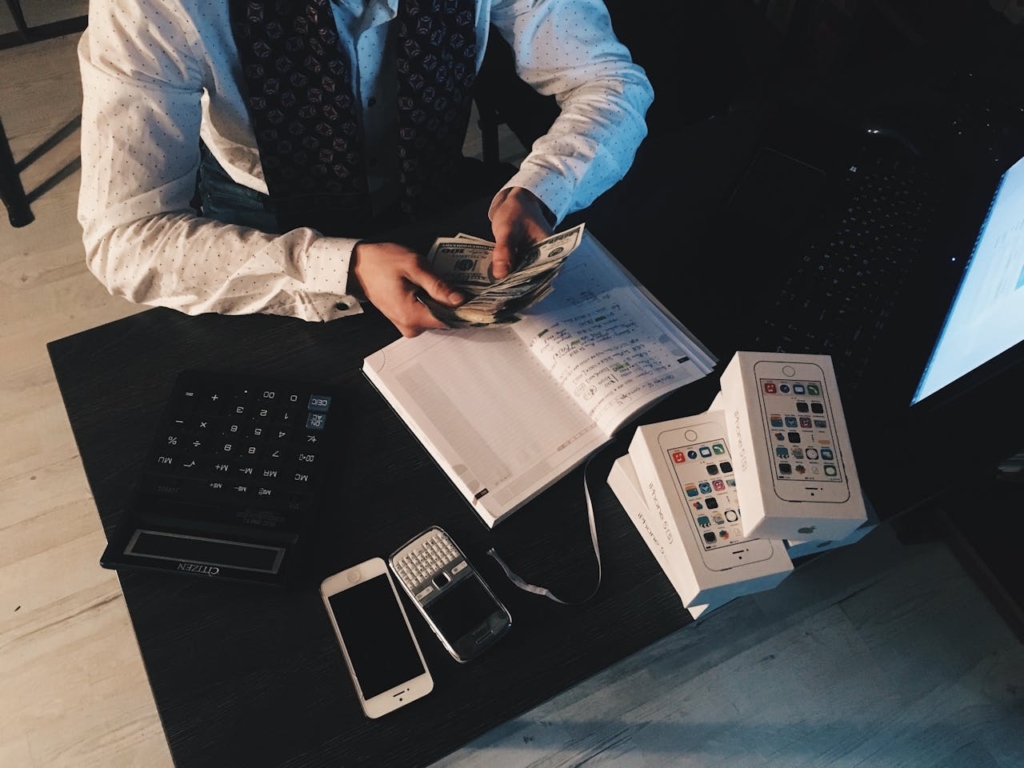

I started investing in property back in 2004 and all I needed at the time to make that very first investment was R2,500.

Yes, that was all I needed to secure the new off-plan townhouse I was buying.

The balance of the money came from the Bank as a homeloan.

As you become more serious about investing in larger deals however or growing your portfolio, the big question for most investors is this….

“Where do I get the money for property deals?”

The answer: Other People’s Money!

The next question however might be…..”Who are these other people and how do I find them?”

In this article I’ll cover a few options that are available to you so you can start building your portfolio.

Identifying Suitable Properties

Selecting the right property is crucial for the success of your No Money Down investment.

Not every property deal will be suitable for a No Money Down transaction.

Most investors may only be interested for example in properties that fit a certain criteria.

Let’s cover some of the criteria that investors or partners might feel is important before they decide to get involved.

- Location: Consider factors like proximity to amenities, transportation, and employment centers. Research neighborhood trends and future development plans. Then check with potential funders if the location is suitable for them. If an investor is not keen for example on township properties, don’t present it to them.

- Property Type: Evaluate whether residential, commercial, or industrial properties align with your investors goals and risk tolerance.

- Condition: Assess the property’s condition to determine potential renovation costs and future maintenance requirements. If there are renovation costs in the deal, check with your funder that going through a refurbishment is something they will be interested in. Some investors may not be keen to take on any development risk.

- Rental Income Potential: If you plan to rent out the property, evaluate its rental income potential based on market demand and rental rates.

Financing Options For No Money Down Deals

Securing the necessary financing is a critical step in a No Money Down property deal.

While normal bonds typically require a down payment, several alternative options can be explored:

Seller Financing:

One of the most obvious options to use other people’s money when buying a property is the owner of that property.

Seller financing, also known as owner financing, is a popular option for property buyers who may not qualify for traditional property loans, as a top-up over and above an existing bond or when a buyer needs more flexible terms.

In this arrangement, the property seller acts as the lender, providing a loan to the buyer.

Key Benefits of Seller Financing:

- Easier Qualification: Seller financing often has less stringent requirements compared to traditional bonds, making it accessible to buyers with a less-than-perfect credit record or limited income.

- Flexible Terms: Sellers can customize the loan terms to suit the buyer’s needs, including interest rates, repayment schedules, and prepayment penalties.

- Potential for Higher Returns: Sellers may be able to earn a higher return on their investment through seller financing compared to traditional sales.

- Building a Relationship: Seller financing can foster a long-term relationship between the buyer and seller.

Potential Drawbacks of Seller Financing:

- Limited Availability: Not all sellers are willing to offer seller financing.

- Higher Interest Rates: Sellers may charge higher interest rates to compensate for the risk involved in providing financing.

- Lack of Legal Protection: Buyers may have limited legal protections compared to traditional mortgages.

Example of a Seller Financing Deal (Scenario 1):

Let’s consider a scenario where a buyer wants to purchase a property priced at R1,500,000.

The buyer may not qualify for a traditional loan due to credit issues or limited income.

- Purchase Agreement: The buyer and seller agree on the purchase price and terms of the seller financing arrangement.

- Deposit: The buyer may or may not require a deposit.

- Loan Amount: The remaining balance of R1,200,000 becomes the loan amount.

- Interest Rate: The seller and buyer agree on an interest rate, such as 13% per annum.

- Repayment Schedule: The seller and buyer establish a repayment schedule, such as monthly payments over a 15-year term.

- Security: The property itself serves as security for the loan.

Seller Financing (Installment Sales) – Scenario 2

- How It Works:

Negotiate with the seller to pay for the property in installments instead of securing a mortgage upfront. This is a flexible option for sellers looking for steady income over time. - South African Context:

The Alienation of Land Act governs installment sales. Ensure the agreement is documented properly, and payments are tracked. - Benefits:

- No immediate need for a large deposit.

- Sellers may offer favorable terms if they need to sell quickly.

- Example:

Paying off a R1 million property in monthly installments over five years while retaining the right to full ownership upon final payment.

By structuring the seller financing deals in this manner, the buyer can acquire the property without needing a normal loan, while the seller can earn a return on their investment.

Key Considerations for Seller Financing:

- Legal Documentation: Ensure that a comprehensive seller financing agreement is in place to protect both parties’ interests.

- Interest Rate: Negotiate a fair interest rate that balances the seller’s financial goals with the buyer’s affordability.

- Repayment Terms: Consider the buyer’s financial capabilities and the seller’s desired cash flow when determining the repayment schedule.

- Prepayment Penalties: If applicable, discuss any prepayment penalties that may be imposed if the buyer pays off the loan early.

- Default Provisions: Outline the consequences of default, such as foreclosure or other remedies.

Hard Money Lenders/Investors:

Hard money lenders are private investors who offer short-term loans secured by the property.

These loans are typically used for quick property purchases, renovations, or bridge financing.

Key Characteristics of Hard Money Loans:

- Short-Term: Hard money loans are typically short-term in nature, ranging from a few months to a year. This makes them suitable for bridge financing or temporary cash flow needs.

- Higher Interest Rates: Hard money lenders charge higher interest rates compared to traditional mortgages. This is due to the increased risk associated with short-term loans and the potential for higher default rates.

- Loan-to-Value (LTV) Ratios: Hard money lenders often have higher LTV ratios than traditional lenders, allowing borrowers to finance a larger portion of the property’s value.

- Focus on Property Value: Hard money lenders primarily assess the property’s value as collateral, rather than relying heavily on the borrower’s creditworthiness.

- Faster Approval Process: Hard money lenders typically have a faster approval process compared to traditional lenders, making them suitable for time-sensitive transactions.

Advantages of Hard Money Loans:

- Quick Access to Funds: Hard money lenders can provide funds quickly, allowing borrowers to capitalize on time-sensitive investment opportunities.

- Flexibility: Hard money lenders can often offer more flexible terms than traditional lenders, such as interest-only payments or adjustable interest rates.

- No Prepayment Penalties: Many hard money lenders do not charge prepayment penalties, allowing borrowers to pay off the loan early without incurring additional costs.

Disadvantages of Hard Money Loans:

- Higher Interest Rates: Hard money loans typically have higher interest rates than traditional mortgages, which can increase the overall cost of borrowing.

- Short-Term Nature: The short-term nature of hard money loans may require borrowers to refinance or sell the property within a specific timeframe.

- Limited Availability: Hard money lenders may be less available in certain markets or may have stricter requirements compared to traditional lenders.

Finding Hard Money Lenders:

- Online Marketplaces: Several online platforms connect borrowers with hard money lenders.

- Real Estate Professionals: Real estate agents and attorneys may have relationships with hard money lenders.

- Referrals: Ask friends, family, or business associates for recommendations.

- Networking Events: Attend industry events to connect with potential lenders.

Important Considerations:

- Compare Rates and Terms: Carefully compare interest rates, fees, and terms offered by different hard money lenders.

- Understand the Exit Strategy: Develop a plan for how you will repay the hard money loan, such as refinancing with a traditional mortgage or selling the property.

- Consider the Risks: Be aware of the risks associated with hard money loans, including higher interest rates and the potential for foreclosure if you are unable to repay the loan.

Partnerships:

Partnerships can be a valuable strategy for acquiring property, especially when dealing with larger investments or limited personal funds. Unlike hard money lenders, partners are individuals or entities who invest their own capital in the property in exchange for a share of the ownership and potential profits.

Key Differences Between Partners and Hard Money Lenders:

- Ownership: Partners become co-owners of the property, while hard money lenders provide loans secured by the property.

- Equity: Partners invest their own equity in the property, while hard money lenders lend money based on the property’s value.

- Return on Investment: Partners typically seek a return on their investment through property appreciation, rental income, or both. Hard money lenders earn interest on the loan.

- Long-Term Commitment: Partnerships often involve a longer-term commitment compared to hard money loans, which are typically short-term.

- Risk Sharing: Partners share the risks and rewards of the investment, while hard money lenders are primarily concerned with the security of their loan.

Types of Partnerships:

- Joint Ventures: Two or more parties collaborate on a specific project, sharing the costs, risks, and profits.

- Limited Liability Partnerships (LLPs): These partnerships offer limited liability to the partners, protecting their personal assets from business debts.

- Syndicates: A group of investors pool their resources to invest in a property or portfolio of properties.

Benefits of Partnering:

- Shared Risk: Partners can spread the risk of the investment across multiple individuals.

- Combined Expertise: Partners can bring different skills and knowledge to the table, enhancing the project’s success.

- Increased Financial Capacity: By pooling resources, partners can undertake larger investments that may be beyond the reach of a single individual.

- Long-Term Relationships: Partnerships can foster long-term relationships and future investment opportunities.

Challenges of Partnering:

- Disagreements: Differences in opinions or goals can lead to conflicts among partners.

- Legal and Tax Implications: Partnering involves legal and tax considerations, such as partnership agreements and the allocation of profits and losses.

- Exit Strategies: Planning for exit strategies, such as selling the property or dissolving the partnership, is important to avoid future disputes.

Finding Hard Money Lenders, Investors, and Partners

Locating reliable hard money lenders, investors, and partners is essential for successful No Money Down property deals.

Here are some effective strategies you can try:

Networking:

- Attend Industry Events: Participate in real estate conferences, workshops and networking events to connect with potential investors and lenders.

- Join Real Estate Groups: Become a member of local real estate investment groups or online forums and communities to engage with like-minded individuals.

- Build Relationships: Develop strong relationships with other professionals in the industry, such as real estate agents, attorneys, and financial advisors.

Online Platforms:

- Crowdfunding Platforms: Explore crowdfunding platforms that specialize in real estate investments. These platforms can connect you with a pool of potential investors.

- Online Marketplaces: Utilize online marketplaces that facilitate connections between investors and borrowers.

- Social Media: Leverage social media platforms to connect with investors and build your online presence.

Private Lending Circles:

- Join Existing Circles: Research and join private lending circles or good stokvels within your community or network.

- Create Your Own Circle: Consider forming your own lending circle with trusted individuals. This could be as simple as getting friends and family within your circle who share your vision to form part of your personal lending circle.

Referrals and Recommendations:

- Leverage Your Network: Ask friends, family, and business associates for recommendations.

- Seek Professional Advice: Consult with real estate agents, financial advisors, or attorneys who may have connections with potential investors or lenders.

Direct Outreach:

- Identify Potential Investors: Research local investors and directly reach out to them with your investment proposal.

- Highlight Investment Opportunities: Clearly articulate the potential returns and risk factors associated with your investment.

Building Credibility :

- Demonstrate Expertise: start creating content on social media and through your blogs and showcase your knowledge of the property market and your experience in real estate investments. This ATTRACTS potential investors to you. Chat with us if you would like to set up an online system that will help you build your brand and attract leads daily.

- Establish Trust: Build trust with potential investors by being transparent, honest, and reliable.

- Create a Strong Investment Proposal: Develop a compelling investment proposal that outlines your investment strategy, financial projections, and risk management plan.

Recommended Books For Further Reading

To expand your knowledge and gain deeper insights into no-money-down property investing, here is a curated list of highly recommended books.

These resources provide a blend of strategies, real-life examples, and actionable advice to help you refine your investment skills and approach.

1. No Money Down Property Investing: How to Build a Property Portfolio Using None of Your Own Money by Kevin McDonnell

This book provides a comprehensive guide to building a property portfolio without using your own money. Kevin McDonnell explains practical strategies like lease options, rent-to-rent, and joint ventures in simple, actionable steps.

- Why It’s Useful:

It offers proven methods to get started with limited resources and insights into negotiating win-win deals with sellers. Perfect for beginners looking for hands-on advice.

2. Real Estate Investing for Beginners With No Money Down: Simple and Effective Strategies for Investing in Real Estate With No Money From Your Pocket by Daniel Lincoln

Daniel Lincoln demystifies the world of real estate investing, focusing on strategies that require little to no personal capital. The book is beginner-friendly and provides clear explanations of concepts like creative financing, leveraging assets, and partnering with others.

- Why It’s Useful:

Ideal for novices, it explains the fundamental principles of no-money-down deals in a straightforward manner, making complex strategies accessible.

3. Investing in Real Estate With Little or No Money Down by Ron Brooks

Ron Brooks breaks down how to navigate the real estate market with minimal resources, focusing on identifying opportunities, leveraging seller financing, and partnering with private investors. The book includes case studies to illustrate successful strategies.

- Why It’s Useful:

It emphasizes practical, low-risk ways to enter the market, making it a great resource for cautious investors.

4. How to Invest in Real Estate With Little or No Money Down by Robert Irwin

Robert Irwin explores various no-money-down strategies, from lease options to seller financing and hard money loans. He offers a balanced view of the benefits and potential pitfalls of each approach.

- Why It’s Useful:

Provides a realistic perspective on the challenges and opportunities in no-money-down investing, helping readers make informed decisions.

5. Raising Capital for Real Estate: How to Attract Investors, Establish Credibility, and Fund Deals by Hunter Thompson

This book focuses on how to secure funding from private investors to finance real estate deals. Thompson shares strategies for building relationships, pitching opportunities, and establishing credibility in the market.

- Why It’s Useful:

A must-read for those looking to scale their investment portfolio by attracting outside funding. It provides detailed guidance on networking and investor management.

6. Raising Private Capital: Build Your Real Estate Investing Empire with Other People’s Money by Matt Faircloth

Matt Faircloth offers a roadmap for using private capital to fund real estate ventures. The book covers how to structure deals, find investors, and ensure compliance with legal requirements.

- Why It’s Useful:

It teaches readers how to create win-win partnerships with investors, a critical skill for successful no-money-down strategies.

7. Real Estate Partnerships: Access More Cash, Acquire Bigger Deals, and Achieve Higher Profits with a Real Estate Partner by Tony Robinson

Tony Robinson dives into the dynamics of real estate partnerships, explaining how to find the right partners, divide responsibilities, and maximize profits. The book also addresses potential challenges in partnerships and how to overcome them.

- Why It’s Useful:

Perfect for investors who want to pool resources and expertise to tackle larger, more lucrative deals.

These books collectively cover a wide range of topics, from creative financing and deal structuring to raising capital and building partnerships.

Whether you’re a beginner or an experienced investor, they offer valuable insights to help you master no-money-down property investing. Start with the book that aligns with your current needs and gradually build your expertise to succeed in the real estate market.

Conclusion: Doing No Money Down Property Deals

No-money-down property deals can be an effective way to enter the property market without the need for significant upfront capital. By using creative financing options, partnering with investors, or negotiating favorable terms with sellers, you can build a property portfolio while minimizing your financial exposure.

However, these strategies require careful planning, a deep understanding of property laws, and a commitment to ethical business practices.

Whether you’re a first-time investor or a seasoned property enthusiast, no-money-down strategies offer a smart way to grow wealth and achieve your investment goals in the property market.

Start small, learn as you go, and with persistence and smart decision-making, the path to property ownership is well within reach—without a big initial capital outlay.

Aslam is from Johannesburg, South Africa and graduated with a BComm degree from the University of South Africa and followed that up with a BComm Hons degree in Finance and Investments.

He has spent over 18 years in the financial services sector, with 12.5 years in the commercial property finance arena with 3 of the major banks in the country.

His specialty being deal structuring and finance solutions for commercial property investors and developers across the commercial property sector, including large scale retail developments, high density residential investments , industrial and office property.

Aslam was also a fast food franchise investor for 7 years, is experienced in digital marketing and online lead generation and has owned and managed multiple residential properties.